What is Private Mortgage Insurance?

If you are looking to buy a home but plan to make a down payment of less than 20%, most lenders will require private mortgage insurance. Mortgage insurance protects the lender against a loss that results from a default on a mortgage loan. If a borrower can't repay an insured mortgage loan as agreed, the lender may foreclose on the property, then file a claim with the mortgage insurer for any loss incurred.

While the primary purpose of private mortgage insurance is to protect the lender, home buyers also benefit. Being able to purchase a home with a smaller down payment can help you buy a home sooner, while keeping money in your pocket to use for other investments or expenses.

Your lender or REALTOR® can provide more information on the benefits, cost and availability of private mortgage insurance in your area and situation.

When Can You Cancel Mortgage Insurance?

If you made a down payment of less than 20% when you purchased your home, your lender likely required PMI. But how long do you need to pay for mortgage insurance?

If you've been making monthly mortgage payments on time, you can request that mortgage insurance be cancelled, your your mortgage is paid down to 80% of the home's original value - and if the property value has not declined.

You lender is obligated to automatically cancel mortgage insurance once your loan reaches 78% of the original value - without regard to market conditions. But again, provided that you are current with your payments.

If you believe your home has increased in value, you may also be able to cancel mortgage insurance based on that increase.

In any case, contact your lender in writing to request cancellation. You'll likely be required to pay for an appraisal to prove the current value of your property.

Other than automatic termination required by law, cancellation always depends on market conditions and your payment history. Contact your lender if you have any questions.

________________________________________________

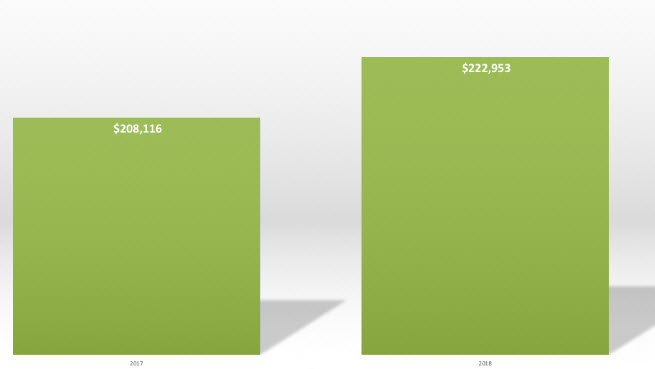

Average Sale Price

Home values continue to rise in West Michigan! The average sale price in the areas we serve was up more than 7% during the 2nd Quarter of 2018.

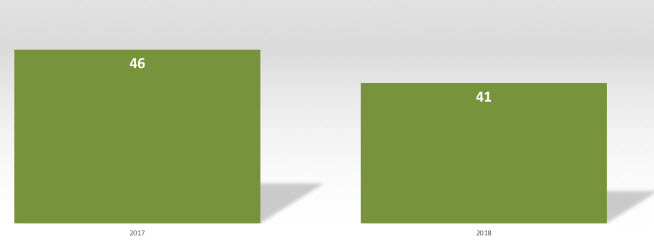

Average Days on Market

The average time on the market was 5 days shorter during the 2nd quarter this year. Homes continue to move quickly - even as prices have increased.

Months of Inventory

The months worth of inventory available is holding fairly steady year over year. However, with less than two and half months of available inventory, properties are still high demand and moving quickly.